Investing in Spanish properties.

Why invest in Spanish properties?

Investing in Spanish properties. Investing in housing has no rival as an investment. There is currently no other financial product with such high profitability. Spain is one of the favorite markets of investors.

Faced with moments of uncertainty, the brick has always been an active haven for investors. Individual investors dare to take the step and see real estate as a safe value to prevent your savings from devaluing and to fight inflation.

Real estate investments in Spain are starting to recover after the pandemic.

A real estate report from Forcadell and the University of Barcelona states that in 2020 when the market was suffering from a “slight” recession, there was a 14.5% decline in transactions, which was far from 32.6% at the start of the 2008 crisis. The decline in the market was less than expected due to many factors: the scarce oversupply, the good attitude of the banks to continue to provide mortgages, low interest rates and the presence of the upper and middle classes who continued to buy.

These conditions meant that after a rapid recovery, we are once again living in a real estate “boom” that would last until 2023, according to the forecasts of this report. Even longer if interest rates remain low. It is predicted, a 15% increase in sales in 2022 and a price increase of 10%. We are therefore at a hopeful time for those looking to invest in real estate on the Costa Blanca.

The coast is especially attractive territory for investors in Spain, in which tourism is the biggest economic force.

What are the most profitable places to invest in Spanish properties?

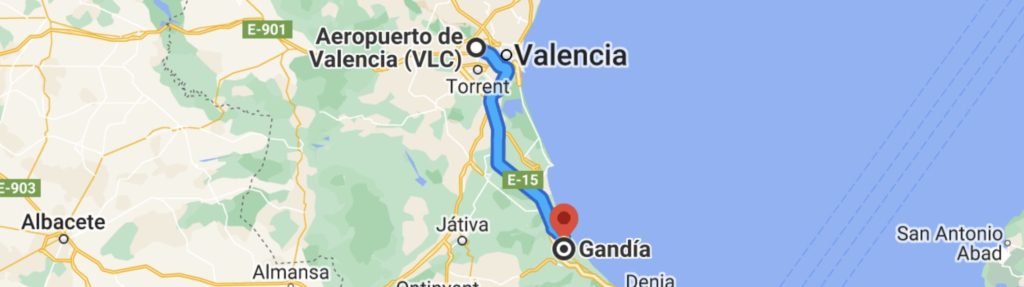

All places on the coast are interesting to invest, but the most profitable coastal towns of Spain are, Gandía and Santa Pola (Elche) in the province of Valancia, these places have seen their profitability double in the last 10 years.

Gandía and Santa Pola are the coastal towns that have a profitability of more than 10%.

The profitability of housing has gone through various scenarios over the past decade. In particular, the places on the Spanish coast that have experienced a post-pandemic change.

As a result, the idea of investing in this type of housing has become more attractive. Proof of this is the place Gandía, which has seen its profitability grow to 11.5% in June 2022, i.e. 6.2% more than ten years ago (June 2013).

Investors are increasingly looking for products that can add some profitability to their assets.

The profitability of the properties of the town of Gandía, followed by the properties located in the town of Santa Pola (10.2%) are higher than the average profitability of Spain (6.9%) itself. Which makes these two places very interesting to invest in.

The profitability of investing / investing in properties on the coast of the Costa Blanca

Over the past decade, the growth in housing profitability in coastal areas has been exponential due to the rise in rents. Although this year’s figures were the best of the last decade, historically the areas near the sea have always been in demand. But with the impact of the pandemic and the search for homes to invest in, coastal rents have skyrocketed, both for those opting for residential rentals and shorter-term vacation rentals.

Why the Costa Blanca?

The Costa Blanca guarantees 325 days of sunshine a year, which is much more days than in the rest of Spain. The average temperature at the coastal towns is 23 degrees and this is also the highest in all of Spain.

The Costa Blanca is extremely popular among different nationalities, such as British, Dutch, Germans, French, Belgians, Northern Europeans and even the Spaniards know why the Costa Blanca is the best location for holidays or a second home.

Tips for investing in real estate in the Costa Blanca

If you want to invest on the Costa Blanca, there are some things you need to take into account to make the process a success.

Especially with homes on the coast, one of the most important aspects is the location. Also think of the orientation and the view. What infrastructure does it have nearby (pharmacies, supermarkets, shops, restaurants, parks and leisure)

Also look at the real estate market and study the real estate prices of similar properties in the same location. If in doubt, have an independent valuation made before you make a purchase.

In which architectural condition is the house located, what are the costs to have any renovations or repairs carried out?

Are there community fees or maintenance costs (think of a swimming pool) and how much do they cost?

What are the costs of the property tax (IBI) per year?

Is the property suitable for rental and how do you want to rent it out? (we will discuss this in more detail in a future blog)

All in all, factors that you should take into account in advance.

We as a team of Inmo Sol y Casas hope that we have been able to help you with the above information.

Wikipedia: The Costa Blanca (Valencian: [ˈkɔsta ˈβlaŋka], Spanish: [ˈkosta ˈβlaŋka], literally meaning “White Coast”) is over 200 kilometres (120 mi) of Mediterranean coastline in the Alicante province, on the southeastern coast of Spain. It extends from the town of Dénia in the north, beyond which lies the Costa del Azahar (or Costa dels Tarongers), to Pilar de la Horadada in the south, beyond which lies the Costa Cálida.

The name Costa Blanca was coined in the 1950s as a way to promote tourism. The region has a well-developed tourism industry and is a popular destination for British and German tourists.

The localities along the Costa Blanca are Alicante (Alicante/Alacant), Altea, Benidorm, Benissa (Benisa), Calp (Calpe), Dénia (Denia), Elche (Elche/Elx), El Campello (Campello), Finestrat, Guardamar del Segura, L’Alfàs del Pi (Alfaz del Pi), Orihuela Costa, Pilar de la Horadada, Santa Pola, Teulada–Moraira, Torrevieja, Villajoyosa (Villajoyosa/La Vila Joiosa) and Xàbia (Xàbia/Jávea). Benidorm and Alicante are the major tourist centres.

Investing in Spanish properties